Multiple Choice

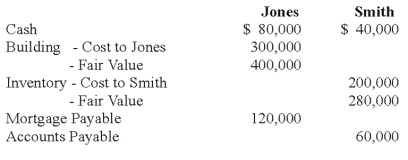

Jones and Smith formed a partnership with each partner contributing the following items:  Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

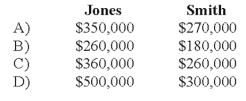

-Refer to the above information. What is each partner's tax basis in the Jones and Smith partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A)I only<br>B)II

Q21: In the AD partnership,Allen's capital is $140,000

Q27: In the AD partnership,Allen's capital is $140,000

Q30: Paul and Ray sell musical instruments through

Q48: The APB partnership agreement specifies that partnership

Q49: The APB partnership agreement specifies that partnership

Q50: The partnership of X and Y shares

Q52: The PQ partnership has the following plan

Q53: Which of the following accounts could be

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the