Multiple Choice

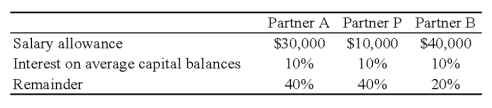

The APB partnership agreement specifies that partnership net income be allocated as follows:  Average capital balances for the current year were $50,000 for A, $30,000 for P, and $20,000 for B.

Average capital balances for the current year were $50,000 for A, $30,000 for P, and $20,000 for B.

-Refer to the information given. Assuming a current year net income of $150,000, what amount should be allocated to each partner?

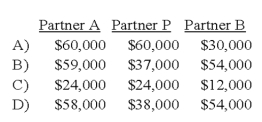

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A)I only<br>B)II

Q17: When the old partners receive a bonus

Q21: In the AD partnership,Allen's capital is $140,000

Q30: Paul and Ray sell musical instruments through

Q44: RD formed a partnership on February 10,

Q49: The APB partnership agreement specifies that partnership

Q50: The partnership of X and Y shares

Q52: The PQ partnership has the following plan

Q53: Which of the following accounts could be

Q57: When a new partner is admitted into