Multiple Choice

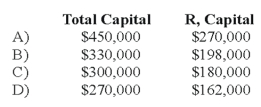

RD formed a partnership on February 10, 20X9. R contributed cash of $150,000, while D contributed inventory with a fair value of $120,000. Due to R's expertise in selling, D agreed that R should have 60 percent of the total capital of the partnership. R and D agreed to recognize goodwill. What is the total capital of the RD partnership and the capital balance of R after the goodwill is recognized?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A limited liability company (LLC):<br>I.is governed by

Q17: When the old partners receive a bonus

Q21: In the AD partnership,Allen's capital is $140,000

Q23: Which of the following accounts is not

Q48: The APB partnership agreement specifies that partnership

Q49: The APB partnership agreement specifies that partnership

Q50: The partnership of X and Y shares

Q57: When a new partner is admitted into

Q59: Which of the following observations is true

Q68: When a new partner is admitted into