Multiple Choice

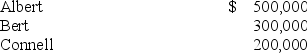

In the ABC partnership (to which Daniel seeks admittance) ,the capital balances of Albert,Bert,and Connell,who share income in the ratio of 5:3:2 are:

-Based on the preceding information,what amount of goodwill will be recorded if Daniel invests $450,000 for a one-third interest?

A) $0

B) $10,000

C) $50,000

D) $100,000

Correct Answer:

Verified

Correct Answer:

Verified

Q56: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q57: When a new partner is admitted into

Q58: In the AD partnership,Allen's capital is $140,000

Q59: Which of the following observations is true

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q62: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q63: In the JK partnership,Jacob's capital is $140,000,and

Q64: Which of the following accounts could be

Q65: Two sole proprietors,L and M,agreed to form

Q66: Griffin and Rhodes formed a partnership on