Multiple Choice

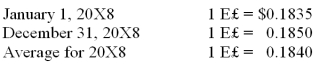

Infinity Corporation acquired 80 percent of the common stock of an Egyptian company on January 1, 20X8. The goodwill associated with this acquisition was $18,350. Exchange rates at various dates during 20X8 follow:  Goodwill suffered an impairment of 20 percent during the year. If the functional currency is the Egyptian Pound, how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

Goodwill suffered an impairment of 20 percent during the year. If the functional currency is the Egyptian Pound, how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

A) $3,670

B) $3,700

C) $3,680

D) $3,690

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Mercury Company is a subsidiary of Neptune

Q11: Seattle, Inc. owns an 80 percent interest

Q15: The assets listed below of a foreign

Q17: Simon Company has two foreign subsidiaries. One

Q18: If the functional currency is the local

Q20: On January 2, 20X8, Johnson Company acquired

Q31: On January 1,20X8,Pullman Corporation acquired 75 percent

Q48: Dividends of a foreign subsidiary are translated

Q59: Michigan-based Leo Corporation acquired 100 percent of

Q59: On January 2, 20X8, Johnson Company acquired