Multiple Choice

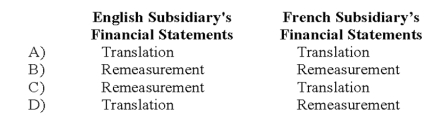

Simon Company has two foreign subsidiaries. One is located in France, the other in England. Simon has determined the U.S. dollar is the functional currency for the French subsidiary, while the British pound is the functional currency for the English subsidiary. Both subsidiaries maintain their books and records in their respective local currencies. What methods will Simon use to convert each of the subsidiary's financial statements into U.S. dollars?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Mercury Company is a subsidiary of Neptune

Q13: Infinity Corporation acquired 80 percent of the

Q15: The assets listed below of a foreign

Q18: If the functional currency is the local

Q19: Dover Company owns 90% of the capital

Q20: If the functional currency is the local

Q31: On January 1,20X8,Pullman Corporation acquired 75 percent

Q38: The balance in Newsprint Corp.'s foreign exchange

Q59: On January 2, 20X8, Johnson Company acquired

Q65: Mercury Company is a subsidiary of Neptune