Multiple Choice

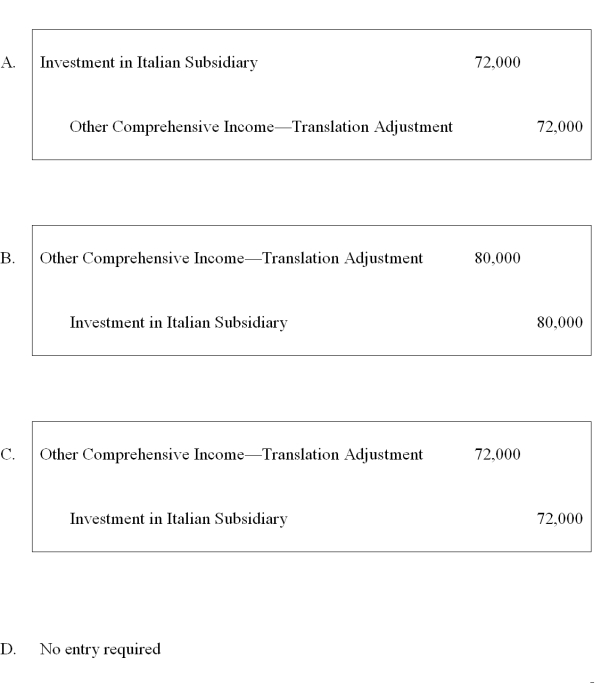

Dover Company owns 90% of the capital stock of a foreign subsidiary located in Italy. Dover's accountant has just translated the accounts of the foreign subsidiary and determined that a debit translation adjustment of $80,000 exists. If Dover uses the fully adjusted equity method for its investment, what entry should Dover record in order to recognize the translation adjustment?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The assets listed below of a foreign

Q17: Simon Company has two foreign subsidiaries. One

Q18: If the functional currency is the local

Q20: If the functional currency is the local

Q23: On January 2, 20X8, Johnson Company acquired

Q24: Which combination of accounts and exchange rates

Q31: On January 1,20X8,Pullman Corporation acquired 75 percent

Q38: The balance in Newsprint Corp.'s foreign exchange

Q59: On January 2, 20X8, Johnson Company acquired

Q65: Mercury Company is a subsidiary of Neptune