Multiple Choice

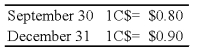

On September 30, 20X8, Wilfred Company sold inventory to Jackson Corporation, its Canadian subsidiary. The goods cost Wilfred $30,000 and were sold to Jackson for $40,000, payable in Canadian dollars. The goods are still on hand at the end of the year on December 31. The Canadian dollar (C$) is the functional currency of the Canadian subsidiary. The exchange rates follow:

-Based on the preceding information,what amount of unrealized intercompany gross profit is eliminated in preparing the consolidated financial statements for the year?

A) $0

B) $5,000

C) $10,000

D) $15,000

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Which of the following statements is true

Q38: The Canadian subsidiary of a U.S.company reported

Q39: If the restatement method for a foreign

Q41: Which combination of accounts and exchange rates

Q42: On September 30, 20X8, Wilfred Company sold

Q45: On January 2, 20X8, Johnson Company acquired

Q47: Dover Company owns 90% of the capital

Q50: South Company is a subsidiary of Pole

Q55: On October 15,20X1,Planet Company sold inventory to

Q56: All of the following stockholders' equity accounts