Multiple Choice

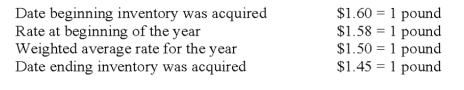

The British subsidiary of a U.S. company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31. The beginning inventory was 10,000 pounds, and the ending inventory was 15,000 pounds. Spot rates for various dates are as follows:  Assuming the dollar is the functional currency of the British subsidiary, the remeasured amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the dollar is the functional currency of the British subsidiary, the remeasured amount of cost of goods sold that should appear in the consolidated income statement is:

A) $108,750.

B) $112,500.

C) $114,250.

D) $125,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Refer to the information in question 52.

Q11: Seattle, Inc. owns an 80 percent interest

Q17: The balance in Newsprint Corp.'s foreign exchange

Q20: On January 2, 20X8, Johnson Company acquired

Q23: Which of the following defines a foreign-based

Q28: On January 2, 20X8, Johnson Company acquired

Q35: Which of the following statements is true

Q48: Dividends of a foreign subsidiary are translated

Q59: Michigan-based Leo Corporation acquired 100 percent of

Q75: On January 2, 20X8, Johnson Company acquired