Multiple Choice

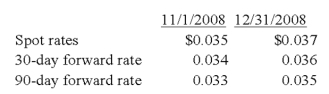

Levin Company entered into a forward contract to speculate in the foreign currency. It sold 100,000 foreign currency units under a contract dated November 1, 20X8, for delivery on January 31, 20X9:  In its income statement for the year ended December 31, 20X8, what amount of loss should Levin report from this forward contract?

In its income statement for the year ended December 31, 20X8, what amount of loss should Levin report from this forward contract?

A) $0

B) $300

C) $200

D) $100

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Taste Bits Inc. purchased chocolates from Switzerland

Q21: Taste Bits Inc. purchased chocolates from Switzerland

Q23: Suppose the direct foreign exchange rates in

Q25: The fair market value of a near-month

Q34: On December 1,20X8,Hedge Company entered into a

Q47: If 1 British pound can be exchanged

Q48: Heavy Company sold metal scrap to a

Q49: The fair market value of a near-month

Q51: On December 1, 2008, Denizen Corporation entered

Q60: Taste Bits Inc. purchased chocolates from Switzerland