Essay

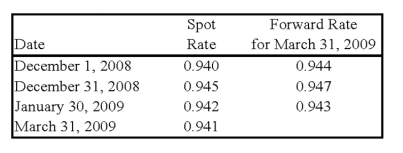

On December 1, 2008, Denizen Corporation entered into a 120-day forward contract to purchase 200,000 Canadian dollars (C$). Denizen's fiscal year ends on December 31. The forward contract was to hedge an anticipated purchase of electronic goods on January 30, 2009. The purchase took place on January 30, with payment due on March 31, 2009. The derivative is designated as a cash flow hedge. The company uses the forward exchange rate to measure hedge effectiveness. The direct exchange rates follow:  Required:

Required:

Prepare all journal entries for Denizen Corporation.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The fair market value of a near-month

Q34: On December 1,20X8,Hedge Company entered into a

Q44: Spiraling crude oil prices prompted AMAR Company

Q46: Levin Company entered into a forward contract

Q48: Heavy Company sold metal scrap to a

Q49: The fair market value of a near-month

Q52: Spiralling crude oil prices prompted AMAR Company

Q54: On December 1, 20X8, Winston Corporation acquired

Q60: On December 1,20X8,Hedge Company entered into a

Q61: On December 1, 20X8, Winston Corporation acquired