Multiple Choice

On December 1,20X8,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

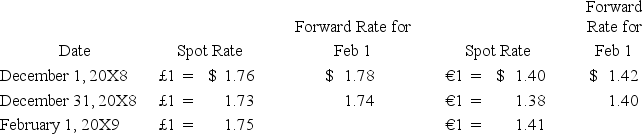

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

-Based on the preceding information,what is the net gain or loss on the euro speculative contract?

A) $8,000 gain

B) $6,000 gain

C) $3,000 loss

D) $1,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q7: On December 1,20X8,Denizen Corporation entered into a

Q8: Taste Bits Inc.purchased chocolates from Switzerland for

Q9: Company X denominated a December 1,20X9,purchase of

Q10: Taste Bits Inc.purchased chocolates from Switzerland for

Q11: On December 1,20X8,Merry Corporation acquired 10 deep

Q13: Mint Corporation has several transactions with foreign

Q14: Suppose the direct foreign exchange rates in

Q15: On March 1,20X8,Wilson Corporation sold goods for

Q16: Quantum Company imports goods from different countries.Some

Q17: Corporation X has a number of exporting