Multiple Choice

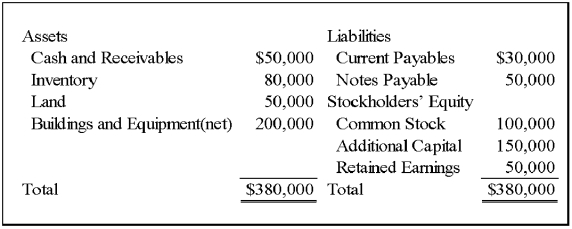

On January 1,20X9,Wilton Company acquired all of Sirius Company's common shares,for $365,000 cash.On that date,Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Wilton Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

-Based on the preceding information,what amount will be present in the revaluation capital account,when eliminating entries are prepared?

A) $0

B) $65,000

C) $60,000

D) $15,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Lea Company acquired all of Tenzing Corporation's

Q11: Top Company obtained 100 percent of Bottom

Q15: On January 1,20X8,Patriot Company acquired 100 percent

Q22: Pace Corporation acquired 100 percent of Spin

Q37: Plant Company acquired all of Sprout Corporation's

Q38: Tanner Company,a subsidiary acquired for cash,owned equipment

Q43: Pail,Inc.holds 100 percent of the common stock

Q44: West, Inc. holds 100 percent of the

Q57: On December 31,20X9,Pluto Company acquired 100 percent

Q65: On December 31, 20X1, Oak Corporation acquired