Essay

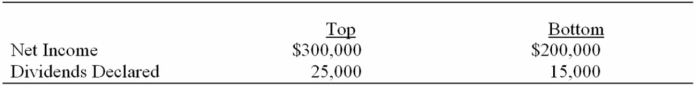

Top Company obtained 100 percent of Bottom Company's common stock on January 1, 20X6 by issuing 12,500 shares of its own common stock, which had a $5 par value and a $15 fair value on that date. Bottom reported a net book value of $150,000 and its shares had a $20 per share fair value on that date. However, some of its plant assets (with a 5-year remaining life) were undervalued by $20,000 in the company's accounting records. Bottom had also developed a customer list with an estimated fair value of $10,000 and a remaining life of 10 years. Top Company uses the equity-method to account for its investment in Bottom. During 20X6 Top and Bottom reported the following:  Required:

Required:

Prepare each of the journal entries listed below related to Top's investment in Bottom.

1. Top's acquisition of Bottom.

2. Top's share of Bottom's 20X6 income.

3. Top's share of Bottom's 20X6 dividend income.

4. Top's amortization of excess acquisition price.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pace Corporation acquired 100 percent of Spin

Q9: Which term refers to the practice of

Q25: On December 31, 20X9, Add-On Company acquired

Q33: On January 1, 20X8, Blake Company acquired

Q34: On January 1,20X8,Patriot Company acquired 100 percent

Q37: Plant Company acquired all of Sprout Corporation's

Q38: Tanner Company,a subsidiary acquired for cash,owned equipment

Q49: Pace Corporation acquired 100 percent of Spin

Q52: On January 1,20X8,Patriot Company acquired 100 percent

Q53: Pirate Corporation acquired 100 percent of Ship