Essay

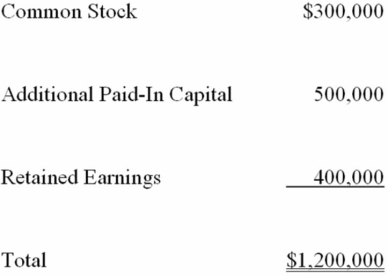

Paco Company acquired 100 percent of the stock of Garland Corp. on December 31, 20X8. The stockholder's equity section of Garland's balance sheet at that date is as follows:  Paco financed the acquisition by using $880,000 cash and giving a note payable for $400,000. Book value approximated fair value for all of Garland's assets and liabilities except for buildings which had a fair value $60,000 more than its book value and a remaining useful life of 10 years. Any remaining differential was related to goodwill. Paco has an account payable to Garland in the amount of $30,000.

Paco financed the acquisition by using $880,000 cash and giving a note payable for $400,000. Book value approximated fair value for all of Garland's assets and liabilities except for buildings which had a fair value $60,000 more than its book value and a remaining useful life of 10 years. Any remaining differential was related to goodwill. Paco has an account payable to Garland in the amount of $30,000.

Required:

1) Present all eliminating entries needed to prepare a consolidated balance sheet immediately following the acquisition.

2) What additional eliminating entry must be prepared at December 31, 20X9?

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which term refers to the practice of

Q25: On December 31, 20X9, Add-On Company acquired

Q28: Which of the following is true? When

Q37: Plant Company acquired all of Sprout Corporation's

Q42: On December 31,20X8,Mercury Corporation acquired 100 percent

Q43: Silver Corporation acquired 100 percent of Bronze

Q46: Plant Company acquired all of Sprout Corporation's

Q49: Pace Corporation acquired 100 percent of Spin

Q53: Pirate Corporation acquired 100 percent of Ship

Q65: On December 31, 20X1, Oak Corporation acquired