Multiple Choice

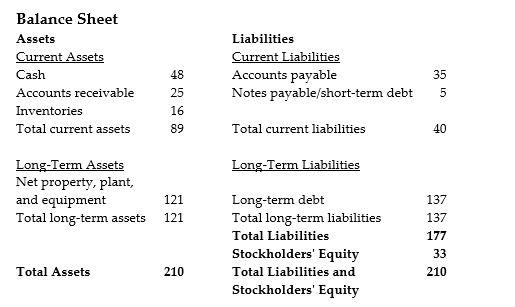

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

A) Net property, plant, and equipment would rise to $126 million, and total assets and stockholders' equity would be adjusted accordingly.

B) Net property, plant, and equipment would fall to $116 million, and total assets and stockholders' equity would be adjusted accordingly.

C) Long-term liabilities would rise to $131 million, and total liabilities and stockholders' equity would be adjusted accordingly.

D) Long-term liabilities would fall to $111 million, and total liabilities and stockholders' equity would be adjusted accordingly.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: What are the four financial statements that

Q41: The third party who checks annual financial

Q53: Which of the following balance sheet equations

Q65: A 30-year mortgage loan is a:<br>A)long-term liability.<br>B)current

Q67: Luther Corporation<br>Consolidated Income Statement<br>Year ended December 31

Q69: A manufacturer of plastic bottles for the

Q71: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" The above diagram

Q72: AOS Industries Statement of Cash Flows for

Q74: Which of the following amounts would be

Q90: In the United States, publicly traded companies