Multiple Choice

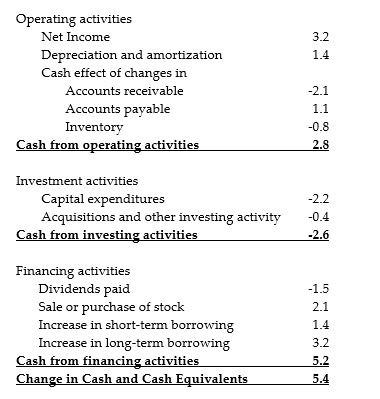

AOS Industries Statement of Cash Flows for 2008

Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

A) It would have $3,000,000 less cash at the end of 2008.

B) It would have $2,925,000 less cash at the end of 2008.

C) It would have $1,500,000 less cash at the end of 2008.

D) It would have an additional $7,500,000 in cash at the end of 2008.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: What are the four financial statements that

Q47: State the names of some of the

Q65: A 30-year mortgage loan is a:<br>A)long-term liability.<br>B)current

Q67: Luther Corporation<br>Consolidated Income Statement<br>Year ended December 31

Q69: A manufacturer of plastic bottles for the

Q70: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" The above diagram

Q71: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" The above diagram

Q74: Which of the following amounts would be

Q76: Which of the following is NOT a

Q90: In the United States, publicly traded companies