Multiple Choice

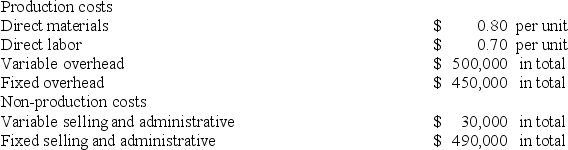

Vision Tester, Inc., a manufacturer of optical glass, began operations on February 1 of the current year. During this time, the company produced 900,000 units and sold 800,000 units at a sales price of $12 per unit. Cost information for this year is shown in the following table:  Given this information, which of the following is true?

Given this information, which of the following is true?

A) Net income under variable costing will exceed net income under absorption costing by $50,000.

B) Net income under absorption costing will exceed net income under variable costing by $50,000.

C) Net income will be the same under both absorption and variable costing.

D) Net income under variable costing will exceed net income under absorption costing by $60,000.

E) Net income under absorption costing will exceed net income under variable costing by $60,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: The bottom line of a contribution margin

Q39: Given the following data, calculate the total

Q45: Fields Cutlery, a manufacturer of gourmet knife

Q46: 32 Degrees, Inc., a manufacturer of frozen

Q47: Wind Fall, a manufacturer of leaf blowers,

Q129: Under an income statement prepared using absorption

Q137: Countdown Inc.sold 17,000 units of its product

Q147: What is a contribution margin report?

Q161: Reporting contribution margin by market segment is

Q163: Contribution margin is also known as gross