Multiple Choice

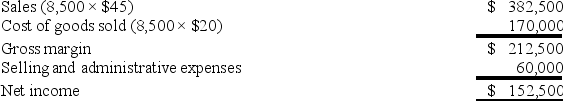

Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the company produced 10,000 leaf blowers and sold 8,500. At year-end, the company reported the following income statement using absorption costing:  Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) . Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) . Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

A) $146,500

B) $158,500

C) $237,500

D) $206,500

E) $246,500

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Vision Tester, Inc., a manufacturer of optical

Q45: Fields Cutlery, a manufacturer of gourmet knife

Q46: 32 Degrees, Inc., a manufacturer of frozen

Q50: Dataport Company reports the following annual cost

Q51: Swola Company reports the following annual cost

Q52: Hayes Inc. provided the following information for

Q93: What is the general procedure for converting

Q137: Countdown Inc.sold 17,000 units of its product

Q163: Contribution margin is also known as gross

Q200: _ is a costing method that includes