Essay

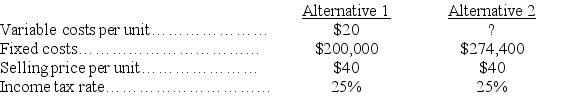

Preston Company is analyzing two alternative methods of producing its product. The production manager indicates that variable costs can be reduced 40% by installing a machine that automates production, but fixed costs would increase. Alternative 1 shows costs before installing the machine; Alternative 2 shows costs after the machine is installed. (a) Compute the break-even point in units and dollars for both alternatives. (b) Prepare a forecasted income statement for both alternatives assuming that 30,000 units will be sold. The statements should report sales, total variable costs, contribution margin, fixed costs, income before taxes, income taxes, and net income. Below the income statement, compute the degree of operating leverage. Which alternative would you recommend and why?

Correct Answer:

Verified

(a)

Alternative 1 break-even in units = ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Alternative 1 break-even in units = ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Raven Company has a target of $70,000

Q70: Forrester Company is considering buying new equipment

Q89: A company has total fixed costs of

Q111: A company manufactures and sells a product

Q125: The extent, or relative size, of fixed

Q155: A firm expects to sell 25,000 units

Q181: A product sells for $200 per unit,and

Q185: Define the break-even point of a company.

Q208: The sales mix of Desert Springs Company

Q209: Scatter diagrams plot volume (units) on the