Essay

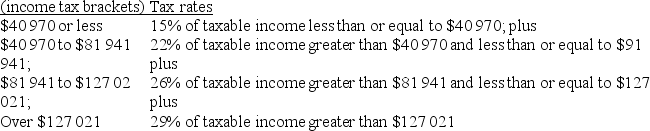

Use the 2010 federal income tax brackets and rates listed below to answer the following question.

Taxable Income

In early 2010, Juan's gross pay increased from $35 000 per year to $43 000 per year.

In early 2010, Juan's gross pay increased from $35 000 per year to $43 000 per year.

a) What was the annual percent increase in Juan's pay before federal income taxes?

b) What was the annual percent increase in Juan's pay after federal income taxes were deducted?

Correct Answer:

Verified

a) Increase in gross...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q182: What is the rate percent if the

Q183: An article was sold for $212.00. The

Q184: 28% of Wendy's monthly salary is deducted

Q185: Betty calculated her 2011 taxable income to

Q186: The price of milk was $3.00 in

Q188: $32 is what percent of $26?

Q189: Use the 2010 federal income tax brackets

Q190: Lorraine, Estelle, and Frances own a business

Q191: Daniel started working for Oracle Canada 2

Q192: You bought a car and got a