Essay

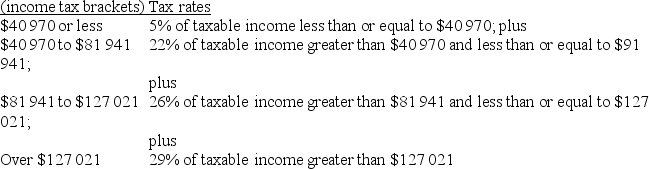

Use the 2010 federal income tax brackets and rates listed below to answer the following question.

Taxable Income

a) Sean had a taxable income of $42 500 in 2011. How much federal income tax should he report? (assuming tax rates remain the same)

a) Sean had a taxable income of $42 500 in 2011. How much federal income tax should he report? (assuming tax rates remain the same)

b) Sean expects his taxable income to increase by 150% in 2012. How much federal tax would he expect to pay in 2012(assuming tax rates remain the same).

Correct Answer:

Verified

a) Federal tax on $42 500 is 0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q184: 28% of Wendy's monthly salary is deducted

Q185: Betty calculated her 2011 taxable income to

Q186: The price of milk was $3.00 in

Q187: Use the 2010 federal income tax brackets

Q188: $32 is what percent of $26?

Q190: Lorraine, Estelle, and Frances own a business

Q191: Daniel started working for Oracle Canada 2

Q192: You bought a car and got a

Q193: Franco, Maria and Gomez entered into a

Q194: In order to encourage Canadians to avoid