Declining Balance Depreciation On July 6,2017,Grayson Purchased New Machinery with an Estimated Useful

Essay

Declining balance depreciation

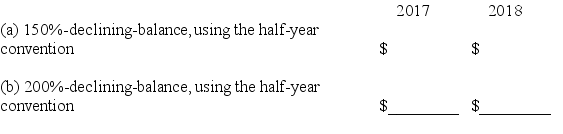

On July 6,2017,Grayson purchased new machinery with an estimated useful life of 10 years.The cost of the equipment was $80,000,with a residual value of $8,000.

Compute the depreciation on this machinery in 2017 and 2018 using each of the following methods.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Accelerated depreciation methods are used primarily in:<br>A)Income

Q7: The term net identifiable assets means:<br>A)All assets

Q8: Depreciation;gains and losses in financial statements<br>In 2016,Amalfi,Inc.purchased

Q9: Intangible assets are assets used in business

Q10: Wanda Company sold an asset for $10,000

Q12: The gain or loss on the disposal

Q13: Estimating the useful life and residual value

Q14: The rule of consistency is violated when

Q15: For depreciable property other than real estate,MACRS

Q16: If an asset is determined to be