Essay

Depreciation;gains and losses in financial statements

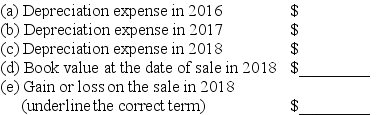

In 2016,Amalfi,Inc.purchased equipment with an estimated 10-year life for $42,600.The residual value was estimated at $9,900.Amalfi uses straight-line depreciation and applies the half-year convention.

On April 18,2018,Amalfi closed one of its plants and sold this equipment for $33,600.Under these assumptions,compute the following for this equipment:

Correct Answer:

Verified

Correct Answer:

Verified

Q3: International standards require that goodwill:<br>A)Be capitalized and

Q4: Coca-Cola's famous name printed in distinctive typeface

Q5: The fair market value of Lewis Company's

Q6: Accelerated depreciation methods are used primarily in:<br>A)Income

Q7: The term net identifiable assets means:<br>A)All assets

Q9: Intangible assets are assets used in business

Q10: Wanda Company sold an asset for $10,000

Q11: Declining balance depreciation<br>On July 6,2017,Grayson purchased new

Q12: The gain or loss on the disposal

Q13: Estimating the useful life and residual value