Multiple Choice

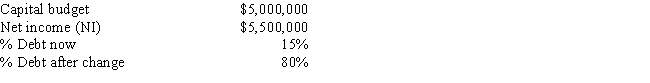

Purcell Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Purcell family members would like for the dividend payout ratio to be increased.If Purcell increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend payout ratio be increased,holding other things constant?

A) 68.5%

B) 60.9%

C) 60.3%

D) 63.8%

E) 59.1%

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Which of the following statements is CORRECT?<br>A)

Q33: Underlying the dividend irrelevance theory proposed by

Q40: If a firm adheres strictly to the

Q48: Becker Financial recently declared a 2-for-1 stock

Q54: Walter Industries is a family owned concern.It

Q57: Grullon Co.is considering a 7-for-3 stock split.The

Q61: Dentaltech Inc.projects the following data for the

Q63: If a firm uses the residual dividend

Q63: NY Fashions has the following data.If it

Q65: D.Paul Inc.forecasts a capital budget of $700,000.The