Multiple Choice

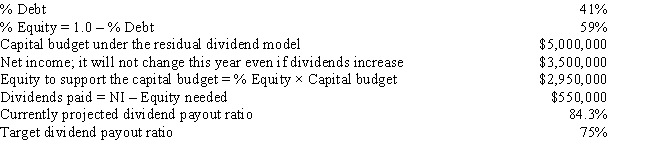

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio?

A) -$3,516,949

B) -$4,044,492

C) -$3,727,966

D) -$4,079,661

E) -$2,919,068

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Other things held constant,the higher a firm's

Q12: Which of the following statements is CORRECT?<br>A)

Q26: Which of the following statements is CORRECT?<br>A)

Q28: Which of the following statements is CORRECT?<br>A)

Q29: Which of the following statements is CORRECT?<br>A)

Q40: If a firm adheres strictly to the

Q48: Becker Financial recently declared a 2-for-1 stock

Q50: Del Grasso Fruit Company has more positive

Q59: Purcell Farms Inc.has the following data,and it

Q63: If a firm uses the residual dividend