Multiple Choice

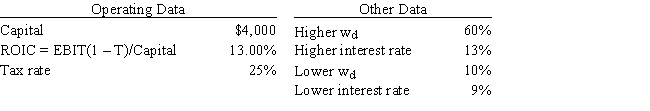

You have been hired by a new firm that is just being started.The CFO wants to finance with 60% debt,but the president thinks it would be better to hold the percentage of debt in the capital structure (wd) to only 10%.Both companies are small,so they are not subject to the interest deduction limitation.Other things held constant,and based on the data below,if the firm uses more debt,by how much would the ROE change,i.e. ,what is ROEHigher - ROELower? Do not round your intermediate calculations.

A) 3.72%

B) 4.18%

C) 4.77%

D) 3.93%

E) 4.68%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: According to Modigliani and Miller (MM),in a

Q8: Companies HD and LD have the same

Q11: Which of the following statements is CORRECT?<br>A)

Q22: Your firm has $500 million of investor-supplied

Q23: Dye Industries currently uses no debt,but its

Q33: Other things held constant,the lower a firm's

Q40: Which of the following would tend to

Q60: Which of the following statements is CORRECT?<br>A)

Q62: Other things held constant,firms with more stable

Q65: Modigliani and Miller's second article,which assumed the