Multiple Choice

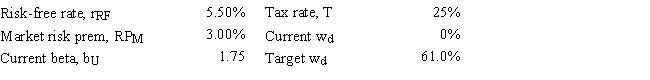

Dye Industries currently uses no debt,but its new CFO is considering changing the capital structure to 61.0% debt (wd) by issuing bonds and using the proceeds to repurchase and retire some common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity,i.e. ,what is rL - rU? Do not round your intermediate calculations.

A) 4.31%

B) 5.23%

C) 7.08%

D) 6.77%

E) 6.16%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: According to Modigliani and Miller (MM),in a

Q8: Companies HD and LD have the same

Q13: A major contribution of the Miller model

Q18: Assume that you and your brother plan

Q22: Your firm has $500 million of investor-supplied

Q26: You have been hired by a new

Q40: Which of the following would tend to

Q41: Financial risk refers to the extra risk

Q62: Other things held constant,firms with more stable

Q65: Modigliani and Miller's second article,which assumed the