Multiple Choice

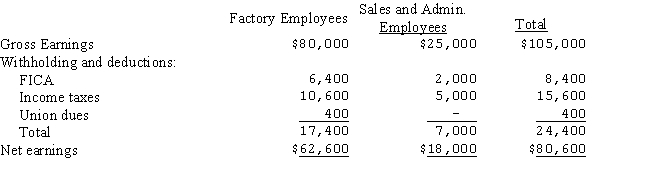

The payroll summary for EVB Inc.for the period August 3 - 10 is as follows:  The entry to record payroll would be:

The entry to record payroll would be:

A) Payroll 105,000 FICA Payable 8,400

Employees Income Tax Payable 15,600

Union Dues Payable 400

Wages Payable 80,600

B) Work in Process 80,000 Factory Overhead 25,000

Payroll 105,000

C) Factory Overhead 80,000 Selling and Administrative Expense 25,000

FICA Payable 8,400

Employees Income Tax Payable 15,600

Union Dues Payable 400

Wages Payable 80,600

D) Payroll 105,000 Wages Payable 105,000

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Of the following taxes,the only one that

Q29: David Andrews works at the Neal Company

Q30: When recording payroll:<br>A)the debit to Work In

Q31: Patrick Poplin is a factory worker at

Q32: The Dehl Company payroll for the first

Q34: Which of the following items relating to

Q35: Daktari Enterprises' Schedule of Earnings and Payroll

Q36: The following payroll summary is prepared for

Q37: An accrued expense such as Wages Payable

Q38: Which of the following would not be