Multiple Choice

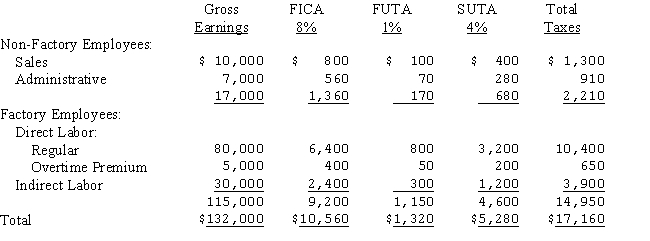

Daktari Enterprises' Schedule of Earnings and Payroll Taxes for April is as follows:  Assuming overhead is a result of the random scheduling of jobs,the entry to record and distribute the employer's payroll taxes would include:

Assuming overhead is a result of the random scheduling of jobs,the entry to record and distribute the employer's payroll taxes would include:

A) A debit to Factory Overhead for $14,950.

B) A debit to FICA Expense of $10,560.

C) A credit to Payroll of $132,000.

D) A debit to Work in Process for $11,050.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: When recording payroll:<br>A)the debit to Work In

Q31: Patrick Poplin is a factory worker at

Q32: The Dehl Company payroll for the first

Q33: The payroll summary for EVB Inc.for the

Q34: Which of the following items relating to

Q36: The following payroll summary is prepared for

Q37: An accrued expense such as Wages Payable

Q38: Which of the following would not be

Q39: Toshlin issues financial statements on June 30.If

Q40: Tyler Jacob is paid $15 per hour