Essay

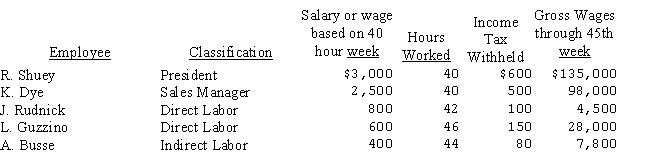

Payroll records for selected employees of Tomco Industries for the forty-sixth week of the year are as follows:  Employees are paid time-and-a-half for overtime.

Employees are paid time-and-a-half for overtime.

Employer payroll tax rates are as follows:

FICA: 8% of first $100,000 of salary or wages

FUTA: 1% of first $8,000 of salary or wages

SUTA: 4% of first $8,000 of salary or wages

Calculate:

(a)Total gross payroll for the selected employees.

(b)Total employer payroll taxes for the selected employees.

Correct Answer:

Verified

(a)  (b)

(b)  Computations:

Computations:

Shuey has alread...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Shuey has alread...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: The file for each factory employee that

Q43: Under a modified wage plan,Jim Phillips works

Q44: Which of the following is not true

Q45: An employee regularly earns $12 per hour

Q46: Becky Graham earns $15 per hour for

Q48: The Wagner Company's Schedule of Earnings and

Q49: Martin Printing pays employees on a weekly

Q50: An analysis of total labor costs into

Q51: Under a modified wage plan,Jim Phillips works

Q52: Daktari Enterprises' Schedule of Earnings and Payroll