Essay

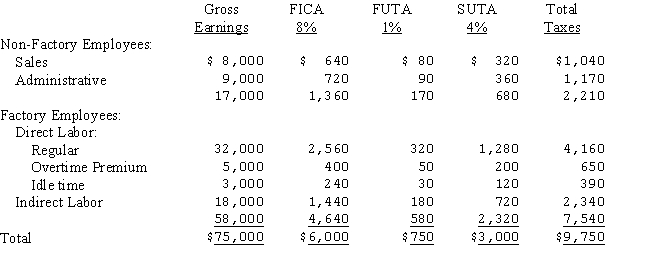

The Wagner Company's Schedule of Earnings and Payroll Taxes for May is summarized as follows:  (a)Prepare the journal entry to distribute payroll under each of the following scenarios:

(a)Prepare the journal entry to distribute payroll under each of the following scenarios:

(1)Overtime resulted from priority scheduling of Job 3bX for which the company received a rush order.

(2)Overtime resulted from random scheduling of jobs.

(b)Prepare the journal entry to record and distribute the employer's payroll taxes.

Correct Answer:

Verified

(a)  Since the overtime resulted from a ...

Since the overtime resulted from a ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: The file for each factory employee that

Q43: Under a modified wage plan,Jim Phillips works

Q44: Which of the following is not true

Q45: An employee regularly earns $12 per hour

Q46: Becky Graham earns $15 per hour for

Q47: Payroll records for selected employees of Tomco

Q49: Martin Printing pays employees on a weekly

Q50: An analysis of total labor costs into

Q51: Under a modified wage plan,Jim Phillips works

Q52: Daktari Enterprises' Schedule of Earnings and Payroll