Essay

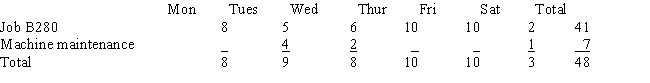

Tyler Jacob is paid $15 per hour for a 40-hour work week with time-and-a-half for overtime,which is not charged to specific jobs.For the week of March 4 - 10,Tyler's labor time record was as follows:  Other Information:

Other Information:

Tyler's year-to-date wages as of March 3 were $7,500.He contributes $20 weekly for his health insurance premiums.

Current tax rates in effect are: FIT withholding rate - 10%;FICA - 8% on the first $100,000 of wages;SUTA - 4% on the first $8,000 of wages;and FUTA - 1% on the first $8,000 of wages.

(a)Calculate Tyler's gross and net pay.

(b)Prepare the journal entries necessary to

(1)Record Tyler's payroll

(2)Pay Tyler's payroll

(3)Distribute Tyler's payroll to the appropriate accounts

(c)Calculate the employer's payroll taxes and prepare the journal entry to record them employer's portion of payroll taxes

Correct Answer:

Verified

(a)

Gross pay:  Deductions:

Deductions:  (...

(...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Gross pay:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Daktari Enterprises' Schedule of Earnings and Payroll

Q36: The following payroll summary is prepared for

Q37: An accrued expense such as Wages Payable

Q38: Which of the following would not be

Q39: Toshlin issues financial statements on June 30.If

Q41: Features of a 401(k)plan include all of

Q42: The file for each factory employee that

Q43: Under a modified wage plan,Jim Phillips works

Q44: Which of the following is not true

Q45: An employee regularly earns $12 per hour