Multiple Choice

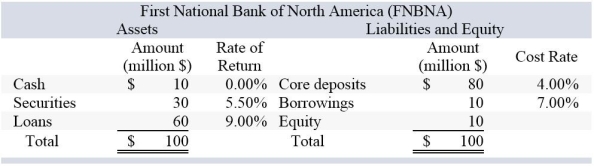

If FNBNA is expecting a $10 million net deposit drain and the securities liquidity index is 0.97,by how much will pretax net income change if the drain is funded entirely through securities sales?

If FNBNA is expecting a $10 million net deposit drain and the securities liquidity index is 0.97,by how much will pretax net income change if the drain is funded entirely through securities sales?

A) −$306,122

B) −$150,000

C) −$375,339

D) −$476,289

E) −$474,490

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following results in a

Q8: A bank has $6 million in Treasury

Q9: When money market interest rates are higher

Q10: Property and casualty insurers have a greater

Q11: In the absence of deposit insurance,a deposit

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6854/.jpg" alt=" What is Second

Q14: Insurance industry guarantee funds do not eliminate

Q15: Relying on purchased liquidity is more risky

Q16: A married couple each has an IRA

Q17: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6854/.jpg" alt=" If FNBNA is