Multiple Choice

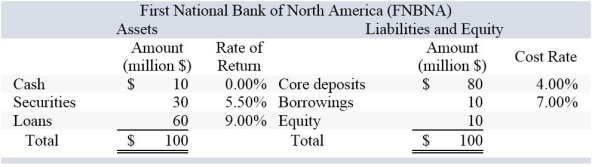

If FNBNA is expecting a $15 million net deposit drain and the securities liquidity index is 0.98,how many securities would have to be liquidated if the bank used only its securities to fund the expected deposit drain?

If FNBNA is expecting a $15 million net deposit drain and the securities liquidity index is 0.98,how many securities would have to be liquidated if the bank used only its securities to fund the expected deposit drain?

A) $15,000,000

B) $16,444,331

C) $15,600,000

D) $15,306,122

E) $16,772,345

Correct Answer:

Verified

Correct Answer:

Verified

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6854/.jpg" alt=" If FNBNA is

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6854/.jpg" alt=" What is Second

Q14: Insurance industry guarantee funds do not eliminate

Q15: Relying on purchased liquidity is more risky

Q16: A married couple each has an IRA

Q18: If a bank meets a net deposit

Q19: The fear that liquidity problems at one

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6854/.jpg" alt=" What are Second

Q21: If a bank relies solely on purchased

Q22: Repos and Fed funds borrowed are examples