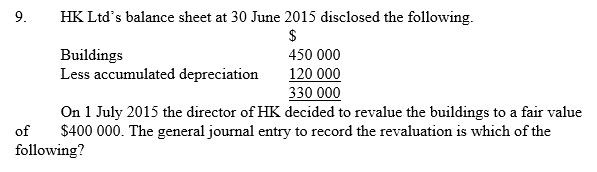

Multiple Choice

A) Debit gain on revaluation $70 000; credit buildings $70 000

B) Debit accumulated depreciation buildings $70 000; credit gain on revaluation $70 000

C) Debit accumulated depreciation buildings $120 000; credit gain on revaluation $70 000; credit buildings $50 000

D) Debit accumulated depreciation buildings $120 000; credit income account $70 000; credit buildings $50 000

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Which statement concerning revaluations that reverse prior

Q42: King Ltd acquired the business of Prince

Q43: On 31 December 2014 an aeroplane with

Q44: A motor vehicle, which had a carrying

Q45: The pair of terms that match is:<br>i.

Q47: Intangible assets may be further classified as:<br>A)

Q48: The carrying amount of a depreciable, non-current

Q49: Recoverable amount is the:<br>A) higher of an

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3115/.jpg" alt=" On 1 January

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3115/.jpg" alt=" A) Accumulated depreciation