Multiple Choice

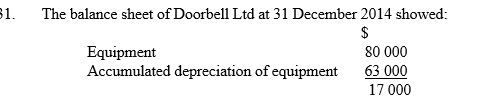

On 1 January 2015 the equipment was sold for $15 000. What is the accounting entry to record the receipt of the proceeds from the sale of the equipment?

On 1 January 2015 the equipment was sold for $15 000. What is the accounting entry to record the receipt of the proceeds from the sale of the equipment?

A) Debit bank $15 000; credit proceeds from sale of equipment $15 000

B) Debit bank $17 000; credit proceeds from sale of equipment $17 000

C) Debit bank $15 000; credit equipment $15 000

D) Debit bank $2000; credit proceeds from sale of equipment $2000

Correct Answer:

Verified

Correct Answer:

Verified

Q45: The pair of terms that match is:<br>i.

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3115/.jpg" alt=" A) Debit gain

Q47: Intangible assets may be further classified as:<br>A)

Q48: The carrying amount of a depreciable, non-current

Q49: Recoverable amount is the:<br>A) higher of an

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3115/.jpg" alt=" A) Accumulated depreciation

Q52: IFRS 3/AASB 3 requires that if the

Q53: Accounting standard IAS 16/AASB 116 requires what

Q54: Which statement relating to mineral resources is

Q55: Which of these terms have the same