Multiple Choice

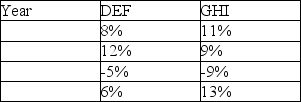

The returns on the stock of DEF and GHI companies over a 4 year period are shown below:

From this limited data you should conclude that returns on

A) DEF and GHI are negatively correlated.

B) DEF and GHI are somewhat positively correlated.

C) DEF and GHI are perfectly positively correlated.

D) DEF and GHI are uncorrelated.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Beta can be defined as the slope

Q21: Modern portfolio theory does not consider diversifiable

Q26: In designing a portfolio, relevant risk is<br>A)

Q37: The CAPM estimates the required rate of

Q62: A stock with a beta of 1.3

Q63: Beta measures diversifiable risk while standard deviation

Q64: What is the expected return on a

Q69: Modern portfolio theory seeks to minimize risk

Q72: You have gathered the following information concerning

Q92: OKAY stock has a beta of 0.8.