Multiple Choice

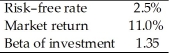

You have gathered the following information concerning a particular investment and conditions in the market.  According to the Capital Asset Pricing Model, the required return for this investment is

According to the Capital Asset Pricing Model, the required return for this investment is

A) 8.85%.

B) 11.48%.

C) 13.98%.

D) 14.85%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Which of the following best describes the

Q21: Modern portfolio theory does not consider diversifiable

Q29: Which one of the following types of

Q37: The CAPM estimates the required rate of

Q67: The returns on the stock of DEF

Q69: Modern portfolio theory seeks to minimize risk

Q73: An investment portfolio should be built around

Q76: For stocks with positive betas, higher risk

Q90: Standard deviation is a measure that indicates

Q92: OKAY stock has a beta of 0.8.