Ginza Enterprises,a Subsidiary of Universal Enterprises Based in Dallas,reported the Following

Multiple Choice

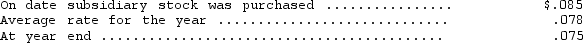

Ginza Enterprises,a subsidiary of Universal Enterprises based in Dallas,reported the following information at the end of its first year of operations (all in yen) : assets--110,000,000;expenses--41,000,000;liabilities--97,500,000;capital stock--5,500,000;revenues--48,000,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

A) $21,000 debit adjustment

B) $76,000 debit adjustment

C) $21,000 credit adjustment

D) $76,000 credit adjustment

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Which of the following is correct regarding

Q21: Which of the following statements is correct?<br>A)

Q22: Transit Importing Company.converts its foreign subsidiary financial

Q23: Global Trading Company.converts its foreign subsidiary financial

Q24: Complete the following statement by choosing the

Q26: Which of the following is NOT a

Q27: The measurement of deferred tax liabilities and

Q28: On July 15,2014,American Manufacturing Inc. ,a Los

Q29: Current generally accepted accounting principles require that

Q30: Which of the following is NOT a