Multiple Choice

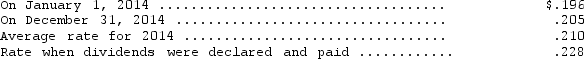

Transit Importing Company.converts its foreign subsidiary financial statements using the translation process.The company's French subsidiary reported the following for 2014: revenues and expenses of 10,500,000 and 6,505,000 francs,respectively,earned or incurred evenly throughout the year,dividends of 500,000 francs were paid during the year.The following exchange rates are available:  Translated net income for 2014 is

Translated net income for 2014 is

A) $910,860

B) $838,950

C) $805,860

D) $733,950

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Which of the following is not correct

Q18: McGovern Corporation,a U.S.company,owns a 100% interest in

Q19: Which of the following is the current

Q20: Which of the following is correct regarding

Q21: Which of the following statements is correct?<br>A)

Q23: Global Trading Company.converts its foreign subsidiary financial

Q24: Complete the following statement by choosing the

Q25: Ginza Enterprises,a subsidiary of Universal Enterprises based

Q26: Which of the following is NOT a

Q27: The measurement of deferred tax liabilities and