Essay

Lunes Company,a U.S.company,owns a 100% interest in its subsidiary,Placido,S.A. ,located in Italy.Placido,S.A. ,began operations on January 1,2014.The subsidiary's operations consist of leasing space in an office building.The building,which cost one million euros,was financed primarily by Italian banks.All revenues and expenses are received and paid in euros.The subsidiary also maintains its accounting records in euros.In light of these facts,management of the U.S.parent has determined that the euro is the functional currency of the subsidiary.

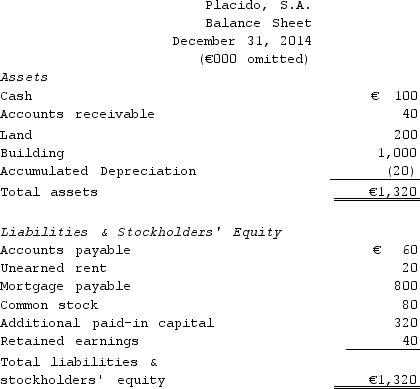

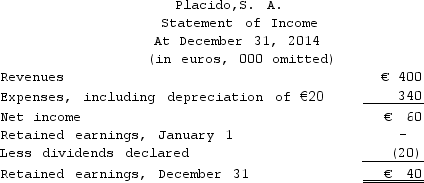

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below,in euros:

The following are relevant exchange rates for the year 2014:

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following statements is true

Q3: Which of the following is the least

Q4: Under international accounting standards,if a sale-leaseback results

Q5: The foreign currency translation adjustments amount is

Q6: A translation adjustment resulting from the translation

Q7: Under international accounting standards,the standard for accounting

Q8: According to FASB ASC Topic 830 (Foreign

Q9: The primary purpose of the Security and

Q10: Florence Enterprises,a subsidiary of Verona Company based

Q11: Under international accounting standards,cash paid for interest