Essay

McGovern Corporation,a U.S.company,owns a 100% interest in its subsidiary,Dukakis Limited. ,located in the United Kingdom.Dukakis began operations on January 1,2013.All revenues and expenses are received and paid in British pounds.The subsidiary maintains its accounting records in British pounds.In light of these facts,management of the U.S.parent has determined that the British pound is the functional currency of the subsidiary.

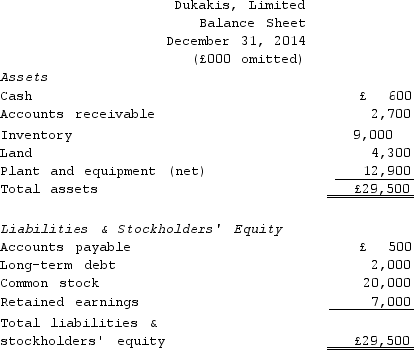

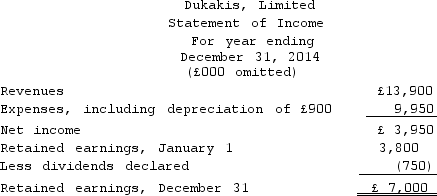

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below in British pounds:

The following are relevant exchange rates for the year 2014:

The following are relevant exchange rates for the year 2014:

£1 = $1.51 at the beginning of 2013,at which time the common stock

was issued.

£1 = $1.55 weighted average for 2014.

£1 = $1.58 at the date the dividends were declared and paid.

£1 = $1.53 at the end of 2014.

£1 = $1.56 at the beginning of 2014.

The balance of the cumulative translation account at January 1,2014,was $1,157.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended for Dukakis,Limited.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Under international accounting standards,the derecognition of receivables

Q14: Financial information for Pinnacle Enterprises at the

Q15: Under international accounting standards,cash paid for income

Q16: Under international accounting standards,the pension-related asset or

Q17: Which of the following is not correct

Q19: Which of the following is the current

Q20: Which of the following is correct regarding

Q21: Which of the following statements is correct?<br>A)

Q22: Transit Importing Company.converts its foreign subsidiary financial

Q23: Global Trading Company.converts its foreign subsidiary financial