Essay

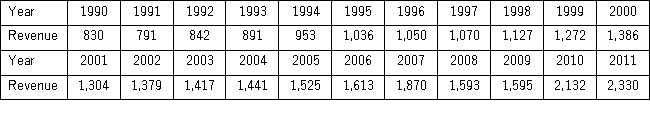

The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

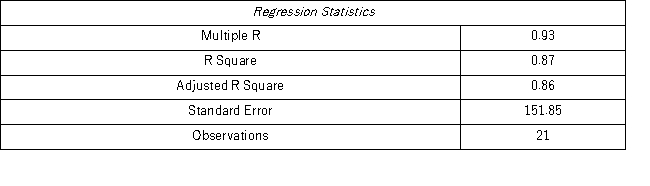

Model AR(1):

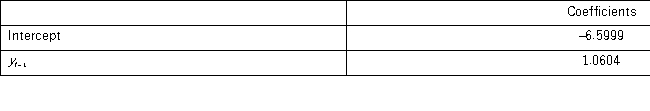

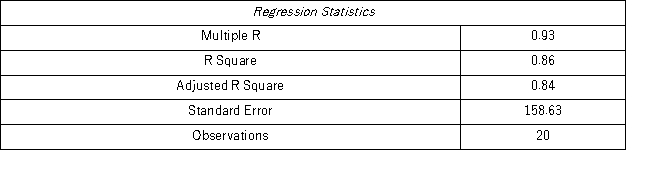

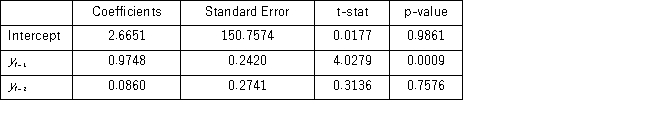

Model AR(2):

Model AR(2):

Compare Excel outputs for AR(1)and AR(2)and choose the forecasting model that seems to be better.

Compare Excel outputs for AR(1)and AR(2)and choose the forecasting model that seems to be better.

Correct Answer:

Verified

AR(1)has one explanatory variable less b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: The following table shows the annual revenues

Q9: Which of the following formulas is used

Q12: The following table includes the information about

Q13: The following table includes the information about

Q15: The following table includes the information about

Q24: Which of the following types of trend

Q27: The _ is a trend model that

Q79: The exponential trend model is attractive when

Q83: The _ method is a smoothing technique

Q107: The centered moving average (CMA), applied in