Multiple Choice

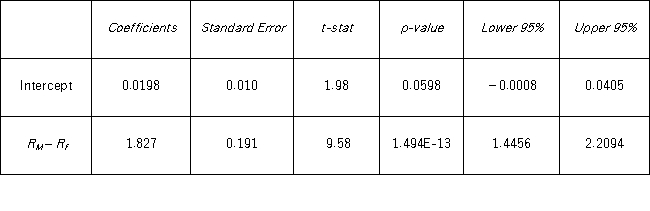

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

A) H0:α = 0;HA:α ≠ 0

B) H0:β = 0;HA:β ≠ 0

C) H0:α ≤ 1;HA:α > 1

D) H0:β ≤ 1;HA:β > 1

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Assume you ran a multiple regression to

Q8: An investment analyst wants to examine the

Q9: In a simple linear regression based on

Q12: Given the following portion of regression results,which

Q13: The accompanying table shows the regression results

Q14: A researcher studies the relationship between SAT

Q15: Which of the following is the correct

Q43: In regression, multicollinearity is considered problematic when

Q75: The _ model is a complete model

Q97: The term BLUE stands for Best Linear