Essay

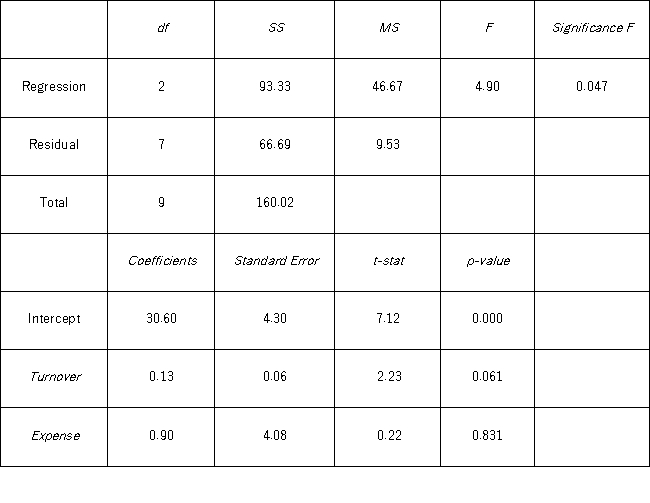

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate,and its expense ratio.She randomly selects 10 mutual funds and estimates: Return = β0 + β1Turnover + β2Expense + ε,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and ε is the random error component.A portion of the regression results is shown in the accompanying table.  a.At the 10% significance level,are the explanatory variables jointly significant in explaining Return? Explain.

a.At the 10% significance level,are the explanatory variables jointly significant in explaining Return? Explain.

b.At the 10% significance level,is each explanatory variable individually significant in explaining Return? Explain.

Correct Answer:

Verified

To conduct the test of joint significanc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A sociologist wishes to study the relationship

Q6: Assume you ran a multiple regression to

Q9: In a simple linear regression based on

Q10: Tiffany & Co.has been the world's premier

Q12: Given the following portion of regression results,which

Q13: The accompanying table shows the regression results

Q43: In regression, multicollinearity is considered problematic when

Q75: The _ model is a complete model

Q97: The term BLUE stands for Best Linear

Q125: Which of the following statements in statistical