Essay

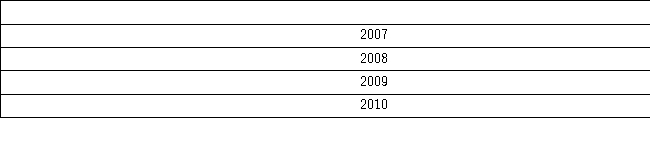

The following table shows the annual returns (in percent)Chevron and Caterpillar for 2007-2010.  a.Which fund had the higher arithmetic average return?

a.Which fund had the higher arithmetic average return?

b.Which fund was riskier over this time period?

c.Given a risk-free rate of 1%,which fund has the higher Sharpe ratio?What does this imply?

Correct Answer:

Verified

The arithmetic average return is calcula...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: In quality control settings, businesses prefer a

Q82: The empirical rule can be used to

Q125: Automobiles traveling on a road with a

Q126: Amounts spent by a sample of 50

Q128: Amounts spent by a sample of 200

Q131: A portfolio's annual total returns (in percent)for

Q132: A bowler's scores for a sample of

Q133: There are five rows of students seated

Q134: The following frequency distribution represents the number

Q135: A portfolio manager generates a 5% return