Multiple Choice

Exhibit 20-2

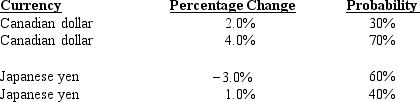

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥) , Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 20-2. What is the probability that the financing rate of the two-currency portfolio is less than the domestic financing rate?

A) 12%.

B) 30%.

C) 100%.

D) 0%.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A firm without any exposure to foreign

Q25: If interest rate parity exists, the attempt

Q45: MNCs can use short-term foreign financing to

Q46: Assume that the Swiss franc has an

Q49: A negative effective financing rate indicates that

Q51: Assume that the U.S. interest rate is

Q52: Assume the U.S. one-year interest rate is

Q53: Exhibit 20-3<br>Cameron Corporation would like to simultaneously

Q54: Exhibit 20-3<br>Cameron Corporation would like to simultaneously

Q55: A firm forecasts the euro's value as