Multiple Choice

Exhibit 20-3

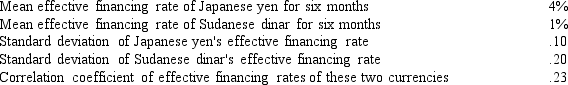

Cameron Corporation would like to simultaneously borrow Japanese yen (¥) and Sudanese dinar (SDD) for a six-month period. Cameron would like to determine the expected financing rate and the variance of a portfolio consisting of 30% yen and 70% dinar. Cameron has gathered the following information:

-Refer to Exhibit 20-3. What is the expected standard deviation of the portfolio contemplated by Cameron?

A) 2.24%.

B) 14.98%.

C) 2.89%.

D) 17.00%.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A firm without any exposure to foreign

Q25: If interest rate parity exists, the attempt

Q45: MNCs can use short-term foreign financing to

Q46: Assume that the Swiss franc has an

Q49: A negative effective financing rate indicates that

Q50: Exhibit 20-2<br>To benefit from the low correlation

Q51: Assume that the U.S. interest rate is

Q52: Assume the U.S. one-year interest rate is

Q54: Exhibit 20-3<br>Cameron Corporation would like to simultaneously

Q55: A firm forecasts the euro's value as