Multiple Choice

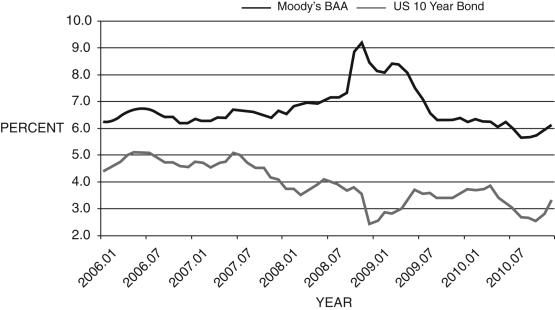

Figure 14.1: BAA and 10-Year Bonds, 2006-2010

-In Figure 14.1 above, the 10-year bond yield is considered ________, while the BAA bond yield represents ________.

A) the federal funds rate; the financial friction

B) the saving rate; the lending rate

C) the financial friction; the prime lending rate

D) a risk-free interest rate; a relatively risky interest rate

E) inflation; the M1 money growth rate

Correct Answer:

Verified

Correct Answer:

Verified

Q87: Consider Figure 14.7 below. Discuss the relationship

Q88: The burst of the housing bubble can

Q89: The Fed's balance sheet normally consists of:<br>A)

Q90: The effect of the subprime loan crisis

Q91: The event that likely caused the financial

Q93: The relatively high growth rate of money

Q94: Which of the following financial reforms were

Q95: The Taylor rule predicted the federal funds

Q96: When an economy is in a deflationary

Q97: In the aftermath of the recent financial